What is the impact of Nickel pricing on significant users of Thermocouple Wire? [UPDATE]

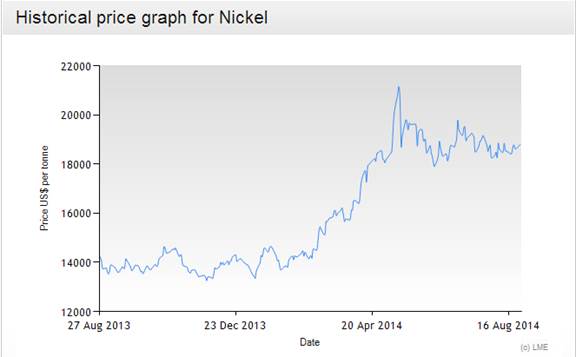

Across the industry, most wire and cable users are aware of the impact that copper prices have on product costs. Copper is a cost factor in many thermocouple (TC) products as well, but TC wire is unique in that Nickel prices have a much more significant impact than copper. After a long period of stability, Nickel has turned volatile this year, up over 35% YTD. The bottom line is this: Most TC types contain a significant amount of Nickel and have become significantly more costly to manufacture over the past few months.

So what exactly has happened in the market for Nickel? How much of an impact does this have on product costs? Is there light at the end of the tunnel? Is there anything significant users can do in response?

With respect to the fluctuating cost of nickel, it is looking like month-to-month on the London Metal Exchange (LME), nickel is hovering at around $18K/ton for contract buyers. There are occasional spikes past the $19K/ton during those uncertain days where everyone starts speculating about the size of the LME stockpile.

Considering what has been happening for the past 12 month, let’s call this a rather stable period. Over the past three months, nickel is averaging around $8.51/lb, however, during the same period last year Nickel was only at $6.49/lb.

So what does this difference and current price mean for significant users of thermocouple wire and the TC wire industry?

The answer to that question varies, and mainly because many TC users are unaware of the Nickel content in what they consume, and don’t recognize this as a potential concern (or perhaps, an opportunity). Our recent blogs on recycling didn’t spur any excitement. Some believed the effort required was unproductive (and perhaps some thought we were simply self-promoting). However, as reported by MetalMiner, “nickel scrap discounts (to LME Nickel) are currently trading at 83-86% and as high as 90% in Asia, up from 70-75% at the start of this year." It’s certainly fair to conclude that the business case for recycling is more compelling given current price levels, particularly if they persist at these levels (or perhaps increase even more).

To better understand the impact, we need to take a deeper dive into what has been happening recently that might have a prolonged effect on nickel prices and transition back on how it affects pricing on certain TC wire products.

- Since the start of the year, nickel is the LME’s best-performing industrial metal this year after being the worst in 2013.

- The three-month contract gained close to 35% since the start of the year, after Indonesia, the world’s biggest miner of the raw material, banned ore exports in January to encourage more domestic processing.

- Russia’s big player, Norilsk Nickel, extracts ore in Russia but refines product in Finland. Overall, Russia is the world’s second-largest producer of nickel products, after China.

- Because China consumes most of its nickel domestically, this leaves Russia as the world’s key supplier. In 2013, Russia accounted for 26% of global nickel cathode exports, or around 13% of total world consumption of nickel. ( www.dailyresourcehunter.com)

- With the sanctions against Russia over the crisis in Ukraine, there was additional pressure around March/April, which had an evident impact on nickel prices.

- In April report by Engineering and Mining Journal, they cite that Vladimir Potanin, CEO Norilsk Nickel, said the medium-term outlook is for stable prices as Indonesia starts its own processed nickel production within the next two years. Anti-Russian sanctions aren't affecting Norilsk's business so far.

- While these are the highest levels the market has seen in 15 months, nickel prices traded around $25,000/mt in 2006, and reached a high of $54,000/mt in 2007 prior to the global financial crisis.

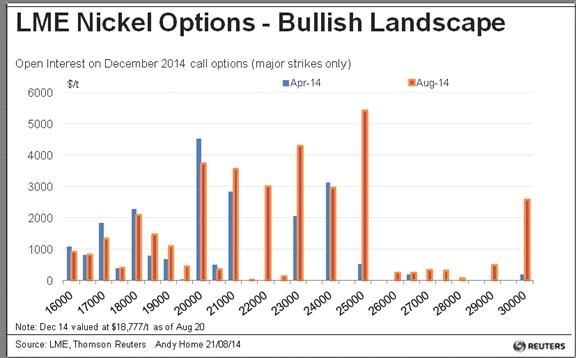

- In another MetalMiner report, they speculate that the Bullish Landscape is strengthening.

Stuart Burns in his report for Nickel Investors states, "Maybe we should not be surprised therefore to see the options market showing a dramatic rise in December open market interest as investors and consumers position themselves for an anticipated rise in refined metal prices later in the year. Consumers believing the worst is behind them as regards the Indonesian export changes will have on the nickel price should review the data. It is entirely possible prices could pick later this year or early next."

This brings us to current day situation:

- LME and Chinese stockpiles seem to be depleting,

- corrections have come and gone and

- most investors seem to have hedged.

Indonesian officials say there are no plans to withdraw the seven-month old ban on exports of unprocessed nickel ore and bauxite.

So what does this mean for thermocouple wire manufacturers and their customers? At the least, we should expect intermediate increases on any products containing nickel before the year end. And depending on what happens at the end of the year, a potential second round of adjustments in early 2015. In the long run, we can hope that the nickel doesn’t go up to 2007 price levels.

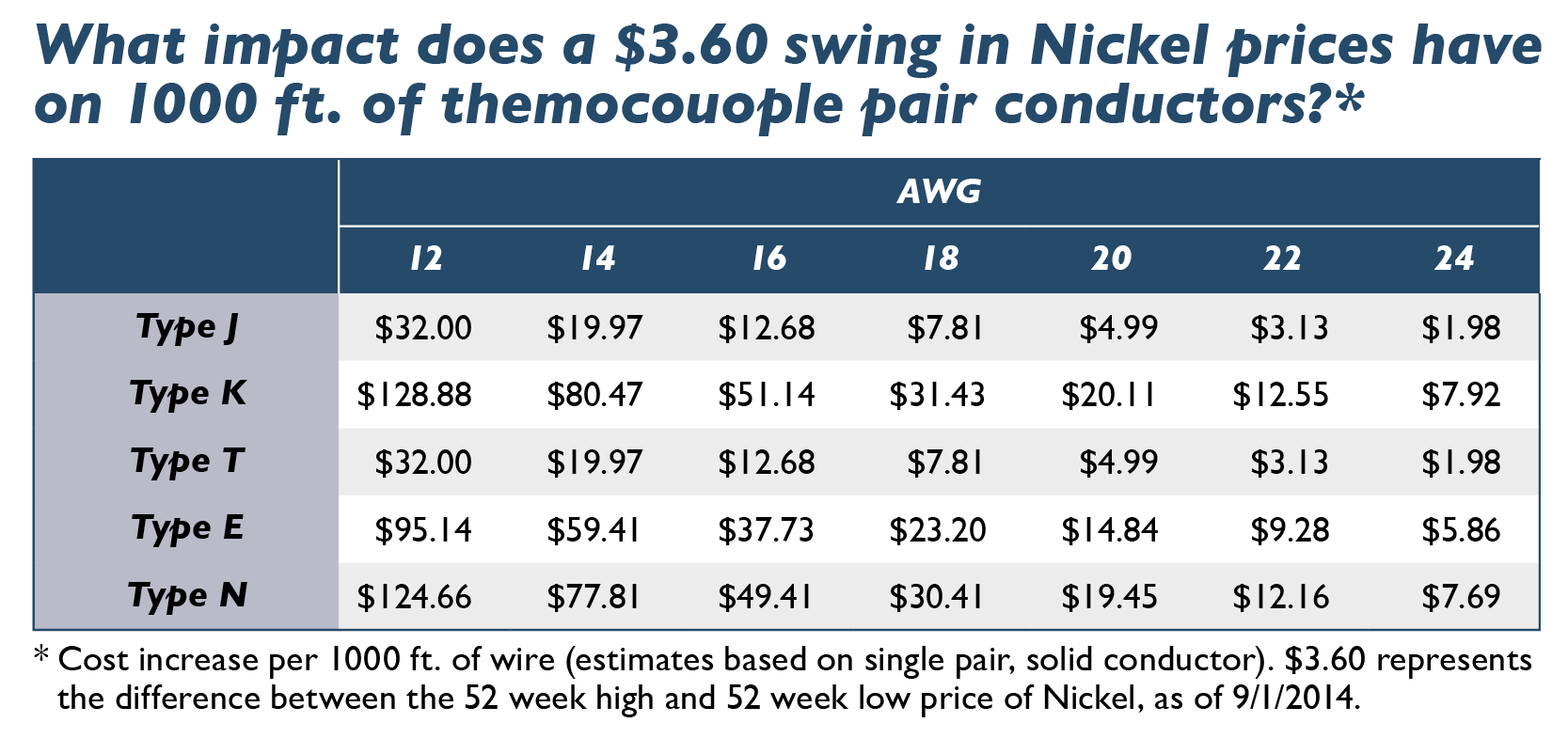

From the perspective of significant users of thermocouple in their manufacturing processes, based on the chemical composition of TC wire, we can anticipate an across the board increases in Type K, Type E and Type N with smaller adjustments in Type J and Type T (see table below).

If you’re a significant user of any of these TC wire types and would like to learn more about calculating nickel surcharges, please contact TE Wire & Cable.

* Disclaimer: As one of the world’s largest manufacturers of thermocouple solutions in the world, TE Wire & Cable keeps an eye on the market conditions related to the various metals used in our products. This article is meant for informational purposes only. It is not intended to provide investment advice based on market trends.